For commercial real estate owners and investors, Net Operating Income (NOI) is the heartbeat of asset performance. It’s the definitive metric that determines value, influences financing, and ultimately dictates profitability. In an industry where margins are meticulously calculated, traditional management methods—reliant on spreadsheets, paper files, and manual processes—are becoming a direct liability. They introduce inefficiency, foster errors, and obscure the data-driven insights needed for strategic decision-making.

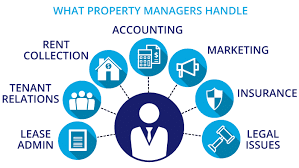

This is where modern commercial property management software transitions from a simple operational tool to a strategic asset. It is the central nervous system for your property, integrating disparate functions into a single, powerful platform. By automating critical workflows and providing unparalleled visibility into performance, this technology directly targets and enhances the key levers that control NOI. Here are five fundamental ways the right platform elevates your bottom line.

1. Automating Rent Collection and Eliminating Delinquency

The most direct impact on NOI is ensuring rental income is received consistently, completely, and on time. Manual rent collection is fraught with delays. It involves generating invoices, mailing statements, depositing checks, and manually tracking down late payments—a process that can consume countless hours.

How the Software Works: A robust commercial property management software solution automates this entire cycle. It features integrated tenant portals that allow for online, automated payments. Tenants can set up automatic ACH transfers, ensuring funds hit your account on the due date without any prompting. The system automatically applies late fees based on pre-configured rules, removing the awkwardness and inconsistency of manual enforcement.

The Direct NOI Impact: This automation virtually eliminates tenant delinquency. You reduce the accounts receivable cycle to zero, improve cash flow predictability, and secure every dollar of revenue you’ve earned. The time your team previously spent chasing payments is reallocated to value-added tasks, further enhancing operational efficiency. This direct recovery of lost revenue and reduction in administrative overhead provides a immediate, tangible boost to NOI.

2. Streamlining Maintenance to Control Costs and Preserve Value

Reactive, disorganized maintenance is a silent budget killer. A small leak left unreported becomes a major repair. An inefficient work order process leads to inflated contractor bills and tenant dissatisfaction, which can impact lease renewals. Unplanned capital expenditures devastate an annual budget.

How the Software Works: The software introduces a proactive, streamlined maintenance management system. Tenants can submit requests 24/7 through a mobile-friendly portal, which automatically creates and routes work orders to pre-approved vendors. Managers can track progress in real-time, approve estimates digitally, and hold vendors accountable against service-level agreements. The software also logs all historical data for each asset, enabling predictive maintenance before small issues become catastrophic failures.

The Direct NOI Impact: This proactive approach significantly reduces overall maintenance and repair costs. You negotiate better rates with vendors through centralized management, avoid costly emergency service premiums, and extend the useful life of capital equipment. Furthermore, prompt maintenance improves tenant satisfaction, a key factor in retention. This dual effect of reducing operating expenses (a key component of the NOI calculation) and supporting steady income through retention directly fortifies your NOI.

3. Mastering CAM Reconciliation and Billing Accuracy

For retail and office properties, Common Area Maintenance (CAM) reconciliations are notoriously complex and a common source of tenant disputes. Miscalculations, missed billable items, or poor documentation can lead to significant revenue leakage or lengthy, costly disagreements.

How the Software Works: This is where technology truly shines. A sophisticated platform automates CAM reconciliation from start to finish. It accurately tracks all eligible expenses against each tenant’s lease terms, calculating their proportionate share with precision. The system generates detailed, auditable reports and tenant-facing statements that transparently break down every charge, from janitorial services to landscaping and property taxes.

The Direct NOI Impact: Automated CAM reconciliation ensures you recover 100% of your recoverable operating expenses. It eliminates human error and provides irrefutable documentation, minimizing disputes and ensuring the process is completed efficiently at the end of each fiscal year. This process directly protects your NOI by guaranteeing that expense burdens are properly allocated to tenants as stipulated in their leases, preventing you from inadvertently subsidizing property operating costs.

4. Enhancing Lease Administration and Avoiding Costly Errors

A lease is the source of all revenue, but its complex terms—option dates, rent escalations, expense stops, and renewal clauses—are difficult to manage manually across a large portfolio. Missing a critical date can result in a below-market renewal or an unwanted extension, directly impacting income for years.

How the Software Works: The software acts as a centralized lease administration hub. It automatically abstracts key lease data and sets alerts for every critical date—90 days before a lease expires, 60 days before a tenant’s option to renew, or when a scheduled rent increase is due. This provides your team with ample time to strategize, negotiate, and take action.

The Direct NOI Impact: This proactive management directly maximizes rental income. You ensure all rent escalations are executed on time and avoid losing revenue through administrative oversight. By strategically managing renewals and expirations, you can minimize vacancy periods and negotiate terms that reflect current market values. This vigilant oversight of the primary source of your revenue is a powerful driver for NOI growth.

5. Leveraging Data Analytics for Strategic Decision-Making

Ultimately, the greatest strength of a modern commercial property management software platform is its ability to transform raw data into actionable intelligence. When financial, operational, and tenant data are siloed in spreadsheets, gaining a holistic view of performance is nearly impossible.

How the Software Works: The platform consolidates all data into a single source of truth. It features powerful dashboards and reporting tools that provide a real-time view of key performance indicators (KPIs): occupancy rates, rent rolls, expense ratios, and profitability by property or tenant. This allows for trend analysis, budgeting, and forecasting with a high degree of accuracy.

The Direct NOI Impact: Data-driven decision-making allows you to optimize your asset strategically. You can identify underperforming areas, adjust marketing budgets to target specific tenant profiles, and make informed capital improvement decisions that yield the highest return. This strategic insight allows you to proactively manage every factor that influences NOI, from revenue generation to cost control, ensuring your property operates at its peak financial potential.

Conclusion: Technology as a Profit Center

Viewing commercial property management software as merely an administrative cost is a outdated perspective. In today’s competitive market, it is a critical investment in profitability. By automating revenue collection, controlling operating expenses, ensuring accurate billing, optimizing lease management, and providing strategic insights, this technology directly addresses the core formula of NOI: maximizing income and minimizing expenses. Implementing the right platform isn’t just about improving efficiency; it’s about installing a powerful engine for financial growth at the heart of your commercial real estate operations.