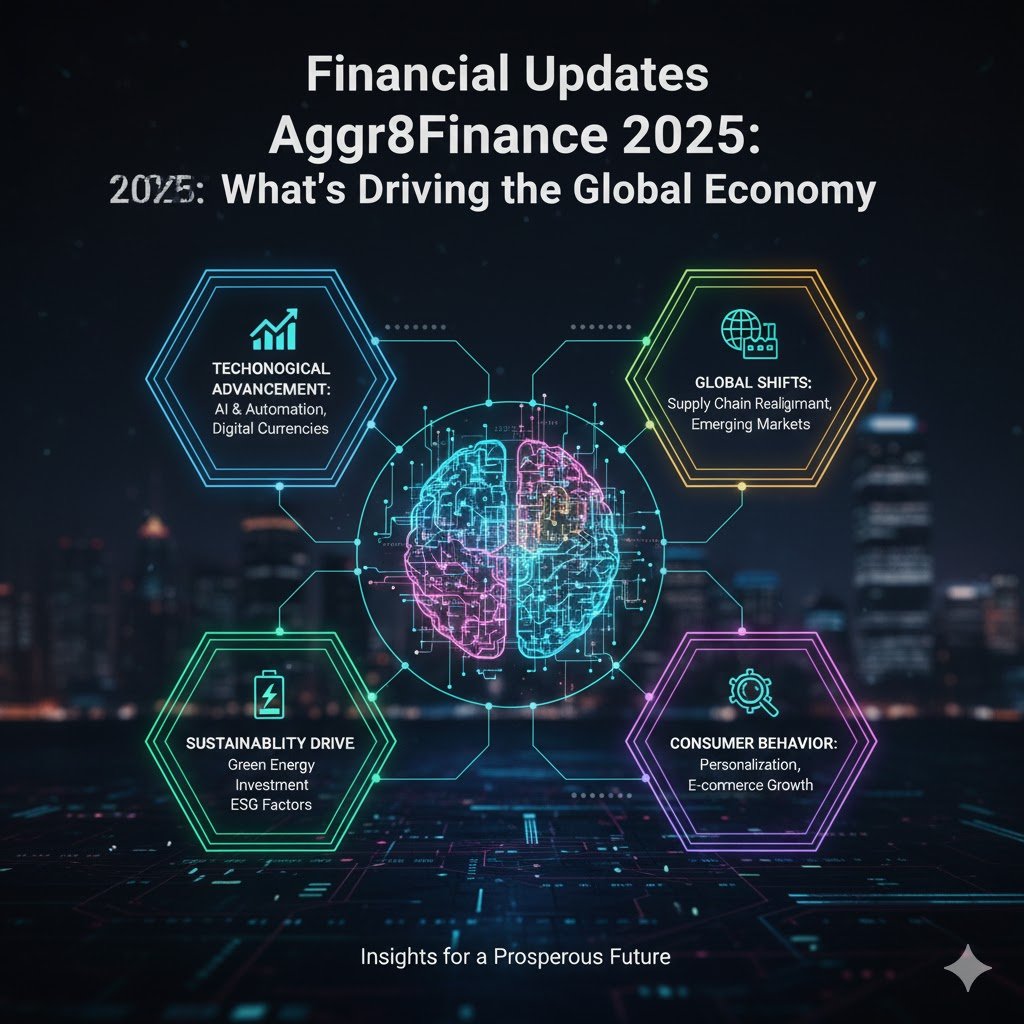

As we navigate the midpoint of the decade, the global economic landscape is being reshaped by a confluence of powerful, and often contradictory, forces. The post-pandemic recovery era is firmly behind us, replaced by a new chapter defined by technological disruption, geopolitical recalibration, and the tangible impacts of climate policy. For investors and business leaders, understanding these currents is not just beneficial—it’s essential for strategic navigation. In this comprehensive analysis, we present the latest financial updates Aggr8Finance has compiled to decode the engines of the 2025 global economy. This overview of financial updates Aggr8Finance provides a clear-eyed look at the key trends, risks, and opportunities defining the year.

The global economy is currently walking a tightrope, balancing resilient growth in certain sectors against significant structural pressures. The insights from our team’s financial updates Aggr8Finance research indicate that we are not headed for a synchronized global boom or bust, but rather a period of “selective expansion.” Here are the primary drivers steering the ship.

1. The AI Integration Tipping Point: From Hype to Hyper-Productivity

Artificial Intelligence has moved beyond speculative investment and into the core operational fabric of major industries. In 2025, we are witnessing the AI productivity dividend begin to materialize in earnest.

Sector-Specific Revolution: It’s no longer just about tech companies. We are seeing massive efficiency gains in manufacturing (predictive maintenance and supply chain optimization), finance (fraud detection and algorithmic trading), and healthcare (personalized medicine and drug discovery). This is translating into improved margins and new revenue streams for early adopters.

Investment Implications: The boom is creating a bifurcated market. Companies effectively leveraging AI are seeing their valuations re-rated, while those slow to adapt are facing investor skepticism. This is a central theme in our financial updates Aggr8Finance equity analysis, highlighting a growing performance gap between the “AI-Enabled” and the “AI-Laggards.”

This technological transformation is the most potent force for growth, but its benefits are unevenly distributed, contributing to market volatility and sector rotation.

2. The “Green Transition” Industrial Boom

The global commitment to decarbonization, backed by substantial policy frameworks like the US Inflation Reduction Act and the European Green Deal, has ignited a full-blown industrial renaissance. This is not a future promise; it is a present-day economic driver.

Supply Chain Reshaping: There is a massive, capital-intensive push to build out entire new supply chains for renewable energy, electric vehicles, and grid infrastructure. This is driving investment in mining for critical minerals, battery production facilities, and semiconductor chips for power management.

Public and Private Capital Alignment: Trillions of dollars are flowing from both public coffers and private equity into sustainable infrastructure projects. This creates a powerful fiscal stimulus that is insulating many Western economies from sharper downturns. Our regular financial updates Aggr8Finance briefs consistently point to the industrial and materials sectors as key beneficiaries of this multi-decade trend.

3. The Persistent Inflation Puzzle and the Central Bank Dilemma

While the acute inflation crisis of 2022-2023 has subsided, the world has not returned to the low-inflation environment of the 2010s. Structural pressures are creating a “stickier” inflation floor.

New Drivers: The primary sources of inflation have shifted from energy and goods to services, wages, and the ongoing costs associated with the green transition and geopolitical fragmentation (often called “greenflation” and “geopolitical inflation”).

Central Bank Caution: Major central banks, including the Federal Reserve and the ECB, are in a delicate holding pattern. They are hesitant to cut rates aggressively for fear of re-igniting inflation, but they are also aware that keeping rates too high for too long could stifle growth. This “higher-for-longer” interest rate environment is a key variable in all our financial updates Aggr8Finance forecasting models, impacting everything from corporate debt costs to housing markets.

4. Geopolitical Fragmentation and the Rewiring of Global Trade

The era of hyper-globalization is over, replaced by a new paradigm of “friend-shoring” and strategic competition. The ongoing tensions between the US and China, coupled with regional conflicts, are forcing a fundamental rewiring of global trade routes.

Supply Chain Resilience Over Efficiency: Companies are prioritizing the security and stability of their supply chains over pure cost minimization. This is leading to increased investment in manufacturing capacity in Mexico, Vietnam, India, and Eastern Europe.

Commodity Market Volatility: This fragmentation introduces new risks and inefficiencies. Energy markets remain particularly susceptible to disruptions, and competition for critical resources is intensifying, creating new geopolitical flashpoints and investment opportunities.

5. The Resurgence of Fiscal Policy

For years, monetary policy (interest rates) was the dominant tool for managing the economy. Today, fiscal policy (government spending and taxation) is making a major comeback.

Industrial Policy: Governments are actively using subsidies and tax incentives to steer strategic industries, notably in semiconductors and clean tech, as seen in the US CHIPS Act.

Debt Sustainability Questions: This elevated government spending, following massive pandemic-era stimulus, has led to record levels of public debt in many nations. The long-term sustainability of this debt is becoming a more prominent topic of debate among economists and a key risk factor monitored in our financial updates Aggr8Finance risk assessments.

Conclusion: Navigating a World in Transition

The global economy in 2025 is not defined by a single narrative but by the interplay of these powerful trends. Investors and policymakers must therefore adopt a nuanced and agile approach. The twin engines of AI and the Green Transition offer historic growth opportunities, but they are set against a backdrop of persistent inflationary pressures, high interest rates, and geopolitical uncertainty.

Success will hinge on the ability to identify companies and nations that are positioned to thrive in this new environment—those with resilient supply chains, technological leadership, and sound balance sheets. By staying informed with thorough and timely analysis, such as the financial updates Aggr8Finance provides, stakeholders can cut through the noise and make strategic decisions with greater confidence. The world is in transition, and with careful navigation, 2025 can be a year of significant opportunity.

Frequently Asked Questions (FAQ)

Q1: With “higher-for-longer” interest rates, what is the best investment strategy for 2025?

A diversified and selective approach is key. Focus on quality companies with strong pricing power and healthy balance sheets (low debt). Sectors benefiting from structural trends like AI and the Green Transition may be better positioned to withstand a restrictive monetary policy. Fixed-income investments like bonds are also offering more attractive yields than in recent years.

Q2: Is a global recession still a major risk in 2025?

The risk has diminished but not disappeared. The resilience of the US economy and the stimulus from the green industrial boom are acting as counterweights. However, a significant geopolitical shock or a central bank policy misstep could still trigger a downturn. The current baseline forecast is for slow, uneven growth rather than a deep contraction.

Q3: How is the economic situation in China affecting the rest of the world?

China’s property sector crisis and slower growth are having a dual impact. It dampens global demand for commodities and luxury goods, but it also exports disinflation to the rest of the world through cheaper manufactured goods. For countries in Asia and Africa, China’s slowdown poses a more direct challenge to their growth.

Q4: What is the single biggest threat to the global economy in 2025?

Most analysts point to a further escalation of geopolitical fragmentation. A severe disruption to critical trade routes, such as those in the South China Sea or key shipping lanes, could trigger a simultaneous energy crisis, supply chain collapse, and a spike in inflation, creating a scenario that would be very difficult for central banks to manage.

Q5: Where are the biggest growth opportunities outside of the tech sector?

Significant opportunities lie in the tangible, physical economy driven by the green transition. This includes companies involved in:

Critical Minerals: Mining and processing of lithium, cobalt, and copper.

Electrical Grid Modernization: Companies building grid infrastructure and energy storage solutions.

Engineering and Construction: Firms tasked with building new manufacturing and energy facilities.