The biweekly pay cycle is a relic of a pre-digital age, a system of payroll patience that often clashes with the immediacy of modern financial life. When an unexpected car repair or medical bill arises a few days before payday, millions of Americans have historically faced a difficult choice: incur overdraft fees, turn to high-interest payday loans, or ask friends or family for help. But a financial technology innovation is challenging this status quo: Earned Wage Access (EWA), often colloquially referred to as earned wage access apps loans.

This article will provide a comprehensive guide to EWA. We will demystify what these platforms are, how they fundamentally differ from traditional loans, the different models they operate under, and their potential benefits and pitfalls. Our goal is to equip you with the knowledge to determine if using an earned wage access apps loans platform is a smart financial tool for your situation.

Defining Earned Wage Access: It’s Not Really a “Loan”

The most critical concept to grasp is that Earned Wage Access is not a loan in the traditional sense. This is a crucial distinction with significant implications for cost and regulation.

A loan is money lent to you by a financial institution, which you must pay back with interest over time. You are borrowing against your future earning capacity. In contrast, EWA is an advance on wages you have already earned but have not yet been paid due to your employer’s payroll schedule.

Think of it this way: if you work 20 hours by Wednesday of a pay period, you have already earned the wages for those 20 hours. Under a standard biweekly system, you might have to wait until the following Friday to receive that money. EWA platforms simply allow you to access a portion of those already-earned funds immediately. Because you are accessing your own money, the fee structure is typically very different from a loan’s interest rate.

Key Takeaway: The term “earned wage access apps loans” is a common misnomer. EWA is a cash advance on earned income, not a debt-based loan.

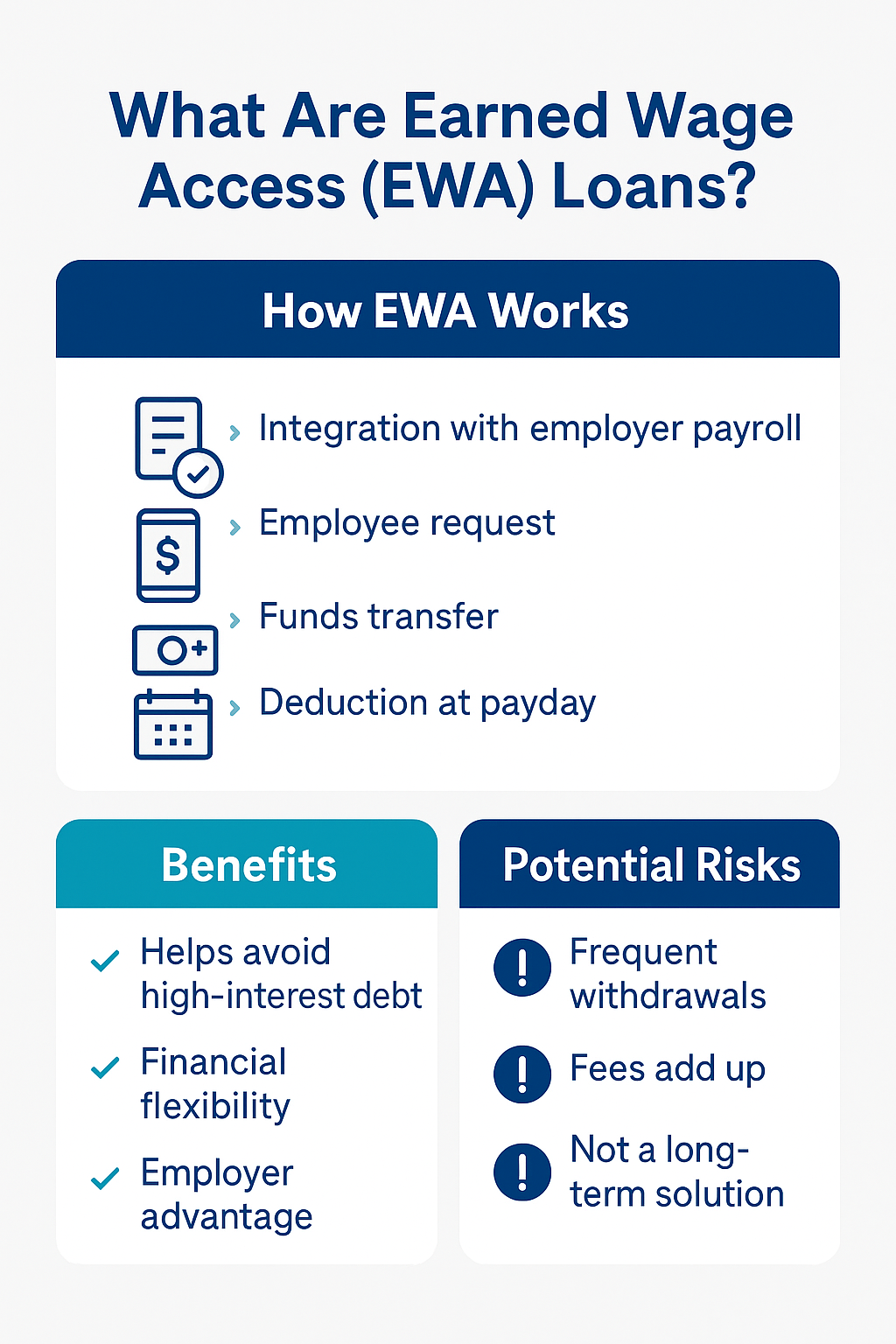

How Do Earned Wage Access Apps Work? The Mechanics of On-Demand Pay

The process of using an EWA service is generally straightforward, though the behind-the-scenes mechanics can vary. Here’s a step-by-step breakdown:

Integration: An employer partners with an EWA provider (like DailyPay, Earnin, or Payactiv). The provider’s system integrates with the company’s time-tracking and payroll software.

Earning and Tracking: As an employee works, their earned wages are tracked in real-time within the EWA app.

Requesting an Advance: When an employee needs funds, they open the app, which shows their available earned balance. They can then request to transfer a portion of that balance (often up to 50-80%) to their personal bank account or a dedicated paycard.

Funding: The transfer of funds can happen almost instantly for a fee, or within 1-2 business days for little or no cost.

Payday Reconciliation: On the official payday, the employer processes payroll as usual. However, the amount already advanced to the employee through the EWA app is deducted from their final paycheck. The employee receives the net remainder.

This process creates a seamless bridge between the work performed and the access to the cash it generates.

MAIN POINTS OF THE NEWS

Core Definition: Earned Wage Access (EWA) is a service that allows employees to access a portion of their already-earned wages before their scheduled payday. It is fundamentally different from a loan as it involves no debt or interest accrual.

Primary Models: There are two main EWA models: Employer-Sponsored (B2B) and Direct-to-Consumer (B2C). The employer-integrated model is generally considered safer and more sustainable, with lower fees for the user.

Cost Structure: EWA is typically low-cost, but not always free. Fees can include optional “tips,” instant transfer fees, or monthly subscriptions. This contrasts sharply with the triple-digit APRs of payday loans.

Regulatory Landscape: The regulatory environment for EWA is still evolving. In the U.S., the CFPB and several states have issued opinions stating that properly structured EWA products are not credit, which exempts them from lending laws, but this is an ongoing discussion.

Financial Impact: Proponents argue EWA promotes financial wellness by reducing overdraft fees and reliance on predatory lending. Critics warn it could lead to habitual use and poor cash flow management if not used responsibly.

The Two Primary Models of Earned Wage Access

Not all EWA platforms are created equal. They primarily operate under two distinct models, which significantly impact the user experience and cost.

1. The Employer-Sponsored Model (B2B)

In this model, the employer proactively partners with and offers an EWA service as an employee benefit. The integration is deep, with the EWA provider directly connected to the company’s payroll and HR systems.

Benefits of this Model:

Lower/Capped Fees: Employers often subsidize the cost, leading to low or no fees for employees.

Enhanced Security: The employer-vetted integration reduces risks associated with sharing bank account information.

Promotion of Financial Wellness: Companies offer this as a benefit to reduce employee financial stress, which can boost productivity and retention.

Examples: DailyPay, Payactiv, Branch.

2. The Direct-to-Consumer Model (B2C)

This model allows individuals to sign up for an EWA app without their employer’s direct involvement. The app uses various methods to verify employment and income, such as requiring access to timesheet data or bank account transaction history to see payroll deposits.

Benefits of this Model:

Accessibility: Available to workers whose employers have not adopted an EWA program.

Ease of Use: Simple sign-up process from the user’s smartphone.

Drawbacks of this Model:

Higher Fees: These platforms often rely on user “tips” or mandatory fees for instant transfers to generate revenue.

Privacy Concerns: Users may need to grant significant access to their bank accounts for verification.

Potential for Overuse: Without employer safeguards, it can be easier to develop a dependency.

Examples: Earnin, Dave.

EWA vs. Payday Loans: A Night-and-Day Difference

This is perhaps the most important comparison. While both provide immediate cash, their structures are worlds apart.

| Feature | Earned Wage Access (EWA) | Payday Loan |

|---|---|---|

| What it is | Advance on earned wages | Short-term, high-interest loan |

| Debt Created | No | Yes |

| Cost | Low, flat fees, tips, or subscriptions | Extremely high APR (often 400%+) |

| Repayment | Automatically deducted from next paycheck | Usually requires a single balloon payment |

| Impact on Credit | Typically none | Can negatively impact credit if not repaid |

| Cycle of Debt | Designed to avoid it | High risk of creating a debt trap |

The critical difference lies in the debt cycle. A payday loan must be repaid in full on your next payday, often leaving you short on cash again, forcing you to take out another loan—a devastating cycle. With EWA, you are only accessing what you’ve earned, and the advance is a percentage of your upcoming check, not an additional debt on top of it.

The Benefits and Potential Risks of Using EWA

Like any financial tool, EWA has its advantages and disadvantages. Responsible use is key.

The Benefits:

Financial Flexibility and Control: Provides a safety net for unexpected expenses, reducing financial stress.

Reduction in Overdraft and Late Fees: By accessing money when needed, users can avoid costly bank fees and late payment penalties on bills.

Alternative to Predatory Lending: Offers a much safer, lower-cost alternative to payday loans and title loans.

Promotes Employee Wellness: For employers, it’s a valuable benefit that shows concern for employees’ financial health.

The Potential Risks and Criticisms:

Habitual Use and Poor Budgeting: If used as a regular crutch, EWA can mask underlying budgeting issues. The convenience may discourage building a traditional emergency fund.

Fees Can Add Up: While cheaper than payday loans, instant transfer fees and recurring subscriptions can become a burden for frequent users.

Data Privacy: Users must trust the EWA provider with sensitive employment and banking data.

Regulatory Uncertainty: The legal classification of EWA is still being defined, which could lead to future changes in how these products operate.

The Evolving Regulatory Landscape

Because EWA is a relatively new product, regulators are grappling with how to classify it. In the United States, the Consumer Financial Protection Bureau (CFPB) issued an advisory opinion in 2020 stating that EWA products that meet certain criteria—namely, that they are an advance on earned wages with no credit risk to the provider and are offered at low or zero cost—are not considered “credit” under the Truth in Lending Act (TILA).

This was a significant victory for the EWA industry, as it exempts them from the stringent disclosure requirements of lending. However, several states are now examining EWA through their own regulatory lenses. The key for consumers is to understand that this is a developing field, and protections may continue to evolve.

A Final Word: Is Earned Wage Access Right for You?

Earned Wage Access represents a powerful shift toward greater employee financial agility. It is a innovative solution that acknowledges the inadequacies of the traditional pay cycle in today’s economy. When used responsibly—as a tool for occasional cash-flow management, not a permanent salary-streaming service—it can be a valuable component of a sound financial strategy.

Before using any service offering earned wage access apps loans, ask yourself these questions:

Is this a one-time need or a recurring pattern?

What are the total fees for the transfer?

What is the reputation of the EWA provider?

Do I have a budget in place to avoid relying on advances?

Ultimately, EWA is a tool. Its value depends on the wisdom of the user. By understanding that it is an advance on your own hard-earned money and not a loan, you can make an informed decision that enhances, rather than hinders, your financial well-being. The world of earned wage access apps loans is here to stay, and being an educated consumer is the first step to using it to your advantage.