In the high-stakes, rapidly evolving world of information technology, your expertise is your most valuable asset. But what happens when a client claims that your expertise—or a simple oversight—cost them money? A missed deadline, a software bug that leads to a security breach, or a flawed system implementation can lead to devastating lawsuits, even if you are not ultimately at fault. This is where Errors and Omissions (E&O) insurance becomes not just a business expense, but a critical component of your risk management strategy.

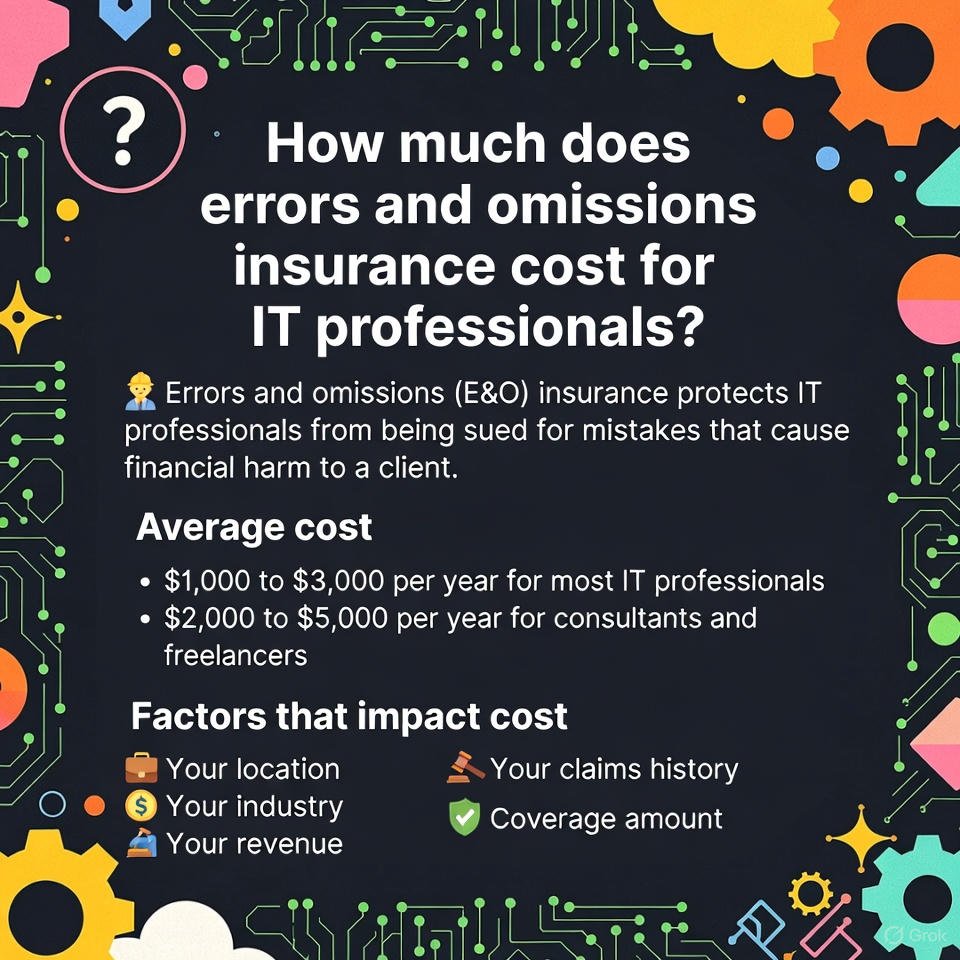

For IT professionals, from independent consultants and software developers to managed service providers (MSPs) and large tech firms, the question isn’t if you need E&O, but how much it will cost. The answer, however, is rarely simple. The errors and omissions insurance cost for an IT professional is not a one-size-fits-all figure. It is a variable, influenced by a complex interplay of your business’s specific profile, the services you offer, and your claims history. Understanding these factors is the first step in securing affordable, robust protection for your livelihood.

This article will demystify the pricing of E&O insurance. We will break down the key determinants of your premium, provide realistic cost ranges for different types of IT professionals, and offer practical strategies to manage your errors and omissions insurance cost without compromising on the quality of your coverage.

You Might Also Like: Roblox Error Code 279 Not Working? Here’s How to Fix It

What is Errors and Omissions Insurance, and Why is it Non-Negotiable for IT?

Before diving into cost, it’s crucial to understand what you’re buying. Errors and Omissions Insurance, also known as Professional Liability Insurance, is designed to protect your business if a client sues you for:

Negligence: Alleging you failed to perform your professional duties to the expected standard.

Errors or Mistakes: A coding error, misconfiguration, or oversight in your work that causes the client financial harm.

Omissions: Something you should have done but didn’t, such as failing to implement a critical security patch.

Undelivered Services: Claims that you failed to deliver on the promises or timelines outlined in a contract.

Breach of Contract: While not its primary purpose, E&O can often cover the legal costs of defending against such claims.

In the IT world, a single mistake can have a cascading effect. For example, if you are a web developer and an e-commerce site you built crashes during a major sale, the client could sue for lost revenue. If you are an MSP and a client’s network is compromised due to a vulnerability you overlooked, they could hold you responsible for the cost of the data breach and reputational damage. E&O insurance covers your legal defense costs, settlements, and judgments, which can easily run into hundreds of thousands of dollars—far beyond what most small IT businesses can afford.

You Might Also Like: How to Fix Marvel Rivals “Failed to Connect to Steam Error 5” in Under 2 Minutes!

The 6 Key Factors That Determine Your Errors and Omissions Insurance Cost

Insurance providers are in the business of assessing risk. The higher they perceive your risk of a claim, the higher your premium will be. Here are the six primary factors that directly influence your errors and omissions insurance cost:

1. Your Specific IT Niche and Services Offered

This is arguably the most significant factor. The type of work you do dramatically impacts your risk profile.

Lower-Risk Tiers: IT consultants who only offer advice, trainers, and hardware installers typically face lower premiums. Their work is less likely to cause a direct, catastrophic financial loss for a client.

Medium-Risk Tiers: Web developers, software developers, and network administrators fall into this category. A bug or misconfiguration can cause significant downtime or data loss, leading to substantial claims.

High-Risk Tiers: Cybersecurity firms, data storage/cloud management companies, and IT professionals handling sensitive financial or healthcare data (which triggers HIPAA compliance concerns) represent the highest risk. A failure in these areas can lead to massive regulatory fines and class-action lawsuits, resulting in a higher errors and omissions insurance cost.

2. Your Business Revenue and Size

Simply put, the more money you make, the larger the potential claims against you can be. A multi-million dollar enterprise will pay significantly more for E&O coverage than a solo consultant generating $100,000 annually. Larger firms also typically have more clients and more projects, which statistically increases their exposure to potential claims.

3. Your Policy Limits and Deductible

These are the levers you can control most directly.

Policy Limits: This is the maximum amount the insurer will pay out for a claim. Common limits are $1 million/$2 million (meaning $1 million per claim and $2 million in total aggregate for the policy period). Higher limits mean the insurer is on the hook for more money, so they charge a higher premium.

Deductible: This is the amount you pay out-of-pocket before the insurance coverage kicks in. Opting for a higher deductible (e.g., $5,000 instead of $2,500) can significantly lower your annual premium. However, you must be confident you can cover the deductible if a claim arises.

4. Your Claims History

An IT professional with a clean history is a far more attractive risk to an insurer than one who has had multiple claims filed against them. A history of claims suggests a pattern of risk, which will lead to a substantially higher errors and omissions insurance cost, or may even make you uninsurable with some carriers.

5. Your Contractual Obligations

Many client contracts, especially with large corporations or government entities, will require you to carry a specific amount of E&O coverage (e.g., $2 million aggregate). They may also demand to be named as an “additional insured” on your policy. These requirements can directly dictate the limits you need to purchase, thereby influencing the cost.

6. Your Business Experience and Risk Management Practices

Insurers look favorably upon established businesses with a track record of stability. They may also offer lower premiums if you can demonstrate robust internal processes, such as:

Using detailed service-level agreements (SLAs) and scope-of-work documents.

Implementing thorough quality assurance and testing protocols.

Providing ongoing employee training and certification.

Having strong data security and backup procedures.

Realistic Cost Ranges: What Can IT Professionals Expect to Pay?

While individual quotes are essential, we can provide general cost ranges to set your expectations. For a typical small IT business (e.g., a solo consultant or a small LLC), annual E&O insurance premiums can range widely.

Solo IT Consultant / Freelancer: If you provide general advice, basic website maintenance, or hardware support, you might secure a policy with a $1 million / $2 million limit for $500 to $1,500 per year.

Software Developer / Web Development Firm: For those who build and deploy custom applications or complex websites, the risk is higher. Expect to pay between $1,000 and $3,500+ per year for a solid $1 million / $2 million policy.

Managed Service Provider (MSP) / Cybersecurity Firm: This is the high-end of the spectrum. Given the critical nature of their services and access to client data, MSPs and cybersecurity experts can expect premiums ranging from $2,500 to $7,000+ annually for adequate coverage. Those handling healthcare or financial data will be at the top of this range or even higher.

It is critical to remember that these are ballpark figures. The final calculation of your errors and omissions insurance cost will be unique to your business. The only way to know for sure is to get quotes from multiple reputable insurers that specialize in covering technology professionals.

You Might Also Like: Fixing Bitly 404 Error on http://bit.ly/4lvzxmj : Complete Guide

5 Practical Strategies to Manage Your Errors and Omissions Insurance Cost

A high quote doesn’t have to be the final word. You can take proactive steps to make your business more attractive to insurers and lower your premium.

Shop Around and Compare Quotes: Never settle for the first quote you receive. The market for professional liability insurance is competitive. Use an independent insurance agent who can obtain and compare quotes from several carriers (known as “A-rated” carriers) on your behalf.

Bundle with Other Insurance Policies (BOP): Many insurers offer a Business Owner’s Policy (BOP), which bundles General Liability insurance with property insurance, often at a discount. You can then add your E&O coverage to this bundle, which can be more cost-effective than purchasing each policy separately.

Choose Your Deductible Wisely: If your business has healthy cash reserves, opting for a higher deductible is one of the most effective ways to reduce your annual premium. Just ensure the deductible is an amount you could comfortably pay if a claim occurred.

Invest in Your Risk Management: Document your processes. Implement strong quality control and data security measures. Train your employees consistently. When you apply for insurance, be prepared to showcase these practices. Insurers may offer discounts for businesses that demonstrate a serious commitment to minimizing risk.

Review and Adjust Your Coverage Annually: Your business is not static, and neither should your insurance be. As your revenue, service offerings, or team size change, your insurance needs will evolve. An annual review with your insurance agent can ensure you are not over-insured (paying for coverage you don’t need) or under-insured, allowing you to optimize your errors and omissions insurance cost continuously.

Estimated E&O Insurance Costs for IT Professionals

The table below assumes a common policy structure of $1 million per claim / $2 million aggregate with a standard deductible (e.g., $2,500).

| IT Professional Profile | Example Roles/Services | Low-End Annual Estimate | High-End Annual Estimate | Key Risk Drivers & Notes |

|---|---|---|---|---|

| Solo IT Consultant / Freelancer | Tech advice, software training, basic hardware installation, non-critical website maintenance. | $500 | $1,500 | Low perceived risk. Cost is highly dependent on revenue. Minimal client data access. |

| Web / Software Developer | Custom application development, e-commerce sites, database design. | $1,000 | $3,500 | Risk of project failure, bugs causing downtime, or unmet specifications. Scope creep is a common claim trigger. |

| Managed Service Provider (MSP) | Ongoing network management, IT support, server maintenance for multiple clients. | $2,500 | $7,000 | High risk due to deep network access. A single error (e.g., failed backup, misconfiguration) can affect multiple clients. |

| Cybersecurity Firm | Vulnerability assessments, penetration testing, security auditing, compliance consulting. | $5,000 | $15,000+ | Very High Risk. Clients rely on your work to prevent catastrophic breaches. A missed vulnerability can lead to massive client losses and lawsuits. |

| IT Firm Handling Sensitive Data | Developers or MSPs working with PHI (Healthcare) or PII (Financial data). | $7,000 | $20,000+ | Highest Risk Tier. Triggers need for HIPAA/etc. endorsements. Exposure to regulatory fines and severe data breach claims significantly increases cost. |

| Data & Cloud Management Firm | Cloud infrastructure management, data storage, SaaS hosting, data analytics. | $4,000 | $12,000 | High risk of service interruption or data loss. Downtime can have direct, significant financial consequences for clients. |

Factors That Directly Adjust Your Premium Within These Ranges

The following levers will move your quote toward the low or high end of the estimated range:

| Factor | Lower Premium (Toward Low-End Estimate) | Higher Premium (Toward High-End Estimate) |

|---|---|---|

| Revenue | < $100,000 | > $1,000,000 |

| Claims History | Zero prior claims | One or more prior claims |

| Deductible | High Deductible (e.g., $10,000) | Low Deductible (e.g., $1,000) |

| Policy Limits | Lower Limits (e.g., $500k/$1M) | Higher Limits (e.g., $2M/$4M) |

| Contract Requirements | No strict client requirements | Client-mandated high limits & “Additional Insured” status |

| Risk Management | Documented QA, strong contracts, employee training | Lack of formal processes |

Conclusion: An Investment in Your Business’s Future

Viewing E&O insurance purely as a cost is a short-sighted approach. For an IT professional, it is a fundamental investment in the stability and longevity of your business. The relatively modest annual premium pales in comparison to the financial catastrophe of a single, uninsured lawsuit.

While the errors and omissions insurance cost for an IT professional can vary based on a myriad of factors, taking the time to understand these variables empowers you to make an informed decision. By accurately representing your business, shopping strategically, and implementing strong risk management, you can secure the vital protection of E&O insurance at a manageable price, giving you the confidence to focus on what you do best: innovating and driving the digital world forward.

Frequently Asked Questions (FAQ)

Q1: Is E&O insurance legally required for IT professionals?

A: Unlike auto insurance, it is not generally required by law. However, it is very often required by contract. Most large clients, government agencies, and corporations will stipulate in their service agreements that you must carry a certain amount of E&O coverage to work with them.

Q2: What’s the difference between E&O insurance and General Liability insurance?

A: General Liability insurance covers physical harm—like if a client trips over a cable in your office and gets injured, or damage to a client’s physical property. E&O insurance covers financial harm caused by your professional advice, services, or mistakes. An IT professional needs both, as they cover entirely different risks.

Q3: I work as a solo freelancer. Do I really need E&O insurance?

A: Absolutely. In fact, solo professionals can be even more vulnerable than larger firms. A single lawsuit from one client could be enough to bankrupt your business and put your personal assets at risk. E&O insurance protects your sole livelihood.

Q4: Does E&O insurance cover claims of data breaches or cyberattacks?

A: This is a critical distinction. A standard E&O policy may cover a claim if a client sues you for failing to prevent a breach due to your negligence. However, it will not cover the direct costs of the breach itself, such as notifying affected customers, credit monitoring services, or regulatory fines. For that, you need a separate, specific Cyber Liability Insurance policy. Many IT professionals bundle E&O and Cyber Liability for comprehensive protection.

Q5: How long does it take to get a quote for E&O insurance?

A: The process can be surprisingly fast. If you have your business information ready (revenue, number of employees, description of services, desired limits), you can often get an initial quote online or through an agent within a few hours to a couple of days.

Q6: Can I be denied E&O coverage?

A: Yes. Insurers can deny coverage if they deem your business too high-risk. This is most common for businesses with a history of multiple claims, those involved in very high-risk activities without robust safeguards, or startups in unproven, volatile tech sectors. Working with an agent who specializes in tech insurance can help you find a carrier willing to cover complex risk profiles.